The Statement of Cash Flows (CF or CF Statement) is one of the "3 Statements". It reports on the amount of cash generated from certain business activities. Specifically, it reports on the cash generated (or consumed) over the same period of time (eg month, quarter, year) as reported by the Income Statement.

Cash is often called the lifeblood of a business. The CF Statement provides insight about where the lifeblood is flowing.

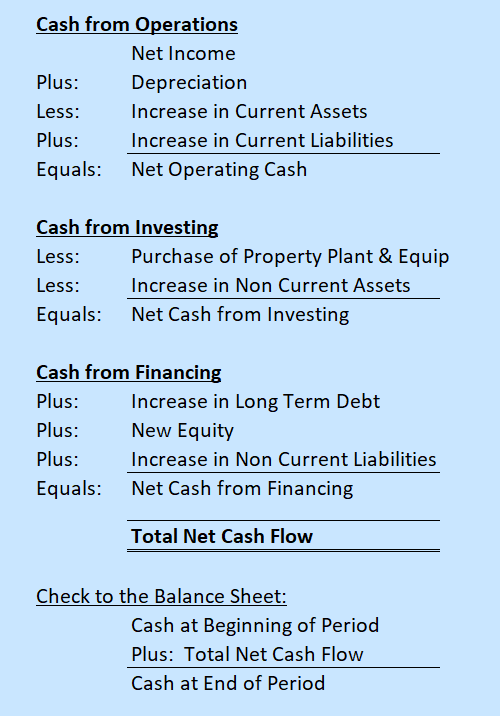

The basic form of the Statement of Cash Flows is:

Using the diagram above as a guide, there are 3 sections of the CF Statement. Detail on each follows:

Cash from Operations

Net Income: The Net Income for the business as reported on the Income Statement.

Depreciation: The depreciation expense related to fixed assets as reported on the Income Statement.

Increase in Current Assets: The amount on the Balance Sheet that the total value of Current Assets increased over the time of the CF Statement (eg month, quarter or year). The value of the increase in Current Assets is deducted because it is a "use of cash". That means, cash was used to purchase assets and, therefore, not available for to be used by the rest of the business. Conversely, if the value of Current Assets decreased, it is considered to be a source of cash. For example, if cash was withdrawn from the bank, it's a source of cash which can be used to pay bills (reduce liabilities).

Increase in Current Liabilities: The amount on the Balance Sheet that the total value of Current Liabilities increased over the time of the CF Statement (eg month, quarter or year). Using similar logic as with Current Assets, if Current Liabilities increase, it's a source of cash (vendors agreed to lend more to the business)....if they decrease, it is a use of cash (vendors were paid).

SECTION TOTAL ==> Net Operating Cash: The net cash generated (or consumed) by business operations and is equal to the sum of Net Income, Depreciation, Less the increase in Current Assets, plus the increase in Current Liabilities.

Cash from Investing

Purchase of Property Plant and Equipment: The cash spent by the business on PPE over the time period of the CF Statement (eg month, quarter or year). This is also known as Capital Expenditure, or CAPX.

Increase in Non Current Assets: The amount on the Balance Sheet that the total value of Non Current Assets increased over the time period of the CF Statement. Similar to the logic outlined earlier, if the value of Non Current Assets increases, it required cash to procure those assets...meaning it is a use of cash.

SECTION TOTAL ==> Net Cash from Investing: The net cash used by making investments in the business. It is equal to the sum of CAPX and the Increase in Non Current Assets, both uses of cash. Accordingly, the total Net Cash from Investing is typically negative.

Cash from Financing

Increase in Long Term Debt: The increase in debt from the Balance Sheet over the time period of the CF Statement. For example, if the Debt value on the Balance Sheet increased, it is a source of cash for the business (eg the bank agreed to lend more). Conversely, if the Debt value decreased, it is a use of cash (eg the bank was paid).

New Equity: The amount of New Equity contributed by investors over the time period of the CF Statement.

Increase in Non Current Liabilities: The increase in Non Current Liabilities from the Balance Sheet over the time period of the CF Statement. For example, if the value of Non Current Liabilities on the Balance Sheet increased, it is a source of cash for the business. Conversely, if they decreased, it is a use of cash (eg the amounts owed were paid).

SECTION TOTAL ==> Net Cash from Financing: The net cash received (or spent) from financing decisions impacting the business. Equal to the sum of the increase in Long Term Debt, New Equity and the increase Non Current Liabilities.

Total Net Cash Flow: The sum of the Net Operating Cash, Net Cash from Investing and the Net Cash from Financing.

Most Financial Models will perform the following math check: the Cash balance at the beginning of the time period of the CF Statement + Total Net Cash Flow = Cash balance at the end of the time period. For example, if the cash balance on 1/1/20 (per the Balance Sheet as of 12/31/19) is $100 and the Total Net Cash Flow for the first quarter is $280, then the cash balance at the end of the quarter must be $380 (per the Balance Sheet as of 3/31/20).

Finally, there's a lot going on in a CF Statement. The good news is that most Financial Models will automatically calculate it. Once the Income Statement and Balance Sheet schedules are projected, the CF Statement is automatically produced because it relies entirely on values contained in the IS and BS.

FAQs ==> here