The Income Statement (IS) is the most common of the "3 Statements". It reports on sales and costs of the business and calculated the profit of the business.

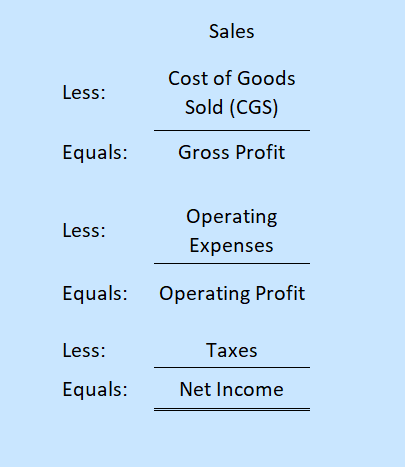

The basic form of an Income Statement is:

Detail on each item follows:

Sales: The dollar amount of sales by the business to customers.

Cost of Goods Sold (CGS): The costs and expenses needed to produce the sales amount.

Gross Profit: Profits produced by subtracting CGS from Sales. The "Gross Profit Margin", or "Gross Margin" is the Gross Profit as a percent of Sales

Operating Expenses: Expenses related of the business which are required to keep the business going, regardless of the amount of sales. Rent or salaries are examples of Operating Expenses.

Operating Profit: Profit produced by subtracting Operating Expenses from Gross Profit.

Taxes: Taxes due the government.

Net Income: The "bottom line" profit of the business.

An Income Statement shows performance over a specific period of time. Often over a one year period, but it can also be for a quarter (3 months) or a single month.

FAQs ==> here